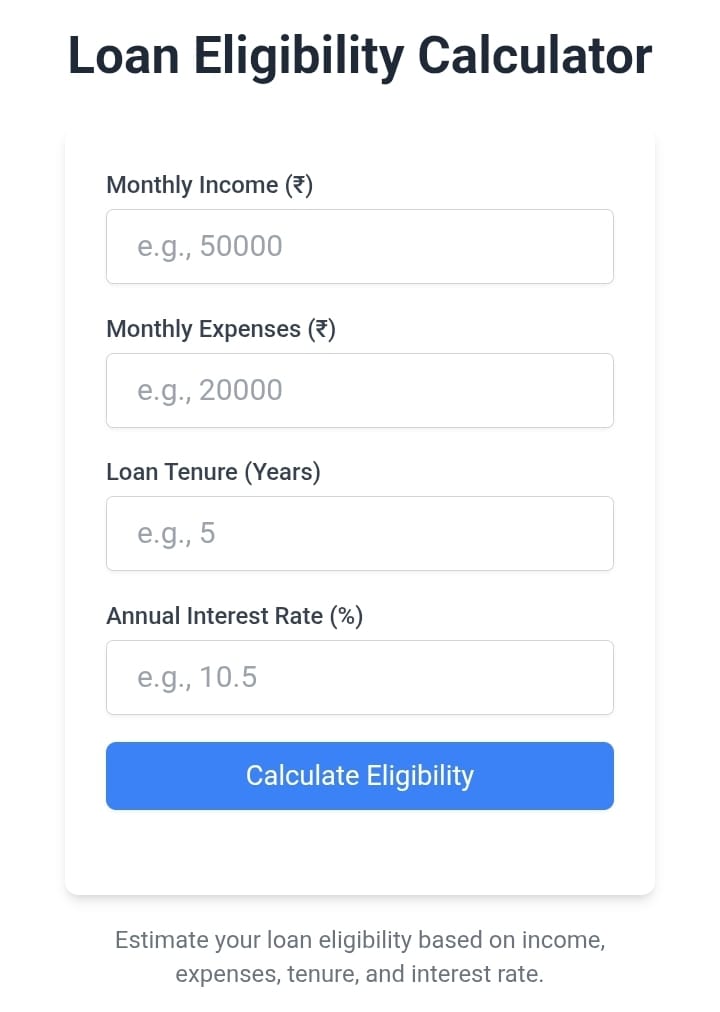

Loan Eligibility Calculator

Estimate your loan eligibility based on income, expenses, tenure, and interest rate.

What is a Loan Eligibility Calculator?

A Loan Eligibility Calculator is an online tool that tells you how much loan you can get from a bank or financial institution. Instead of guessing, you can quickly check your loan amount in seconds. You just enter your income, expenses, and loan type, and the tool gives you the result.

Why Use a Loan Eligibility Calculator?

Applying for a loan without knowing eligibility can waste time. This calculator gives a clear idea of your borrowing capacity. It helps you plan better before approaching a bank. Students, families, and business owners can use it to check whether they qualify for personal loans, home loans, or car loans.

It also prevents loan rejection, as you already know the right amount you can apply for.

How Does It Work?

The calculator uses simple data to give accurate results. You need to enter:

- Your monthly or yearly income

- Your current expenses

- Loan tenure and interest rate

The tool then calculates your repayment capacity and shows how much loan you are eligible for. This makes the process easy and stress-free.

Benefits of Loan Eligibility Calculator

- Quick results – Get answers in seconds.

- Accuracy – Shows realistic loan eligibility.

- Better planning – Apply only for the amount you can repay.

- Free and simple – Anyone can use it without expert knowledge.

Using this calculator, you can save time, reduce stress, and prepare well before applying for a loan.

FAQs about Loan Eligibility Calculator

Q1. Is this calculator free to use?

Yes, you can use it online without paying anything.

Q2. Does it guarantee loan approval?

No, it only shows an estimate. Final approval depends on the bank.

Q3. Who should use it?

Anyone planning to apply for a loan, like personal, home, or car loan, can use this tool.